Rental Inflation Slows Further, Offering Modest Relief

lyWelcome to our UK Rental Market Update July 2025.

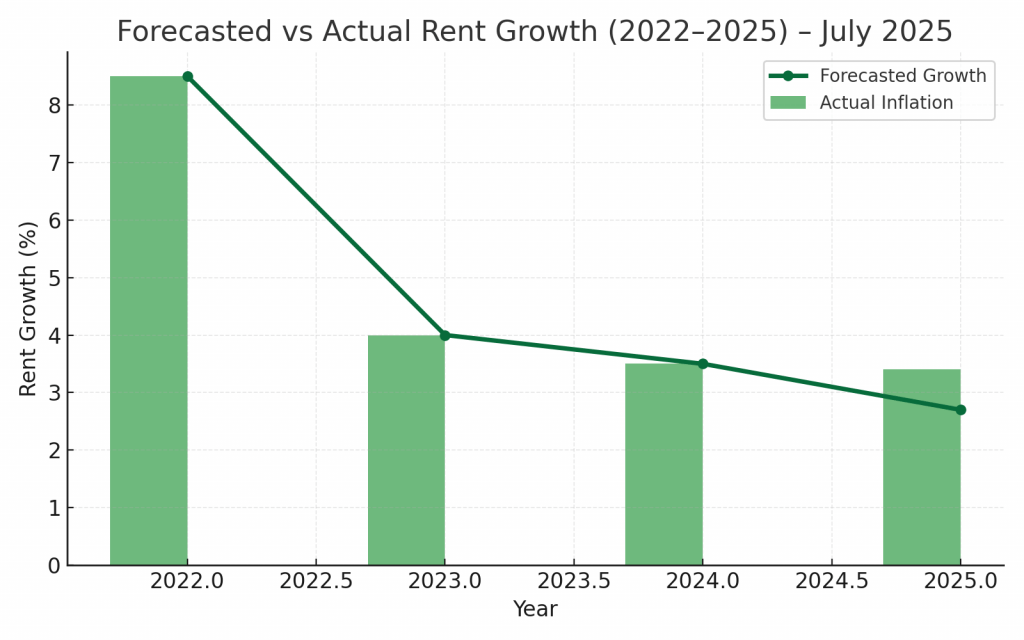

In July 2025, the UK rental market continued its gradual cooling phase. Average annual rental inflation eased to 3.4%, down from June’s 3.6%. This is the fourth consecutive month of decline, signaling that the market is slowly correcting after years of rapid growth.

Key statistics for July 2025:

Actual Rental Inflation: 3.4%

Forecasted Rent Growth (2025): 2.7% (down slightly from 2.8% in June)

What’s driving this continued moderation:

Affordability ceilings: Many tenants are reaching their maximum budget, limiting rent increases.

Stable economic conditions: Wage growth and broader inflation remain steady.

Increased tenant relocation: More renters are moving to suburban or regional areas to find value, easing pressure in high-cost urban markets.

Rental Demand Eases Slightly but Remains Above Historic Levels

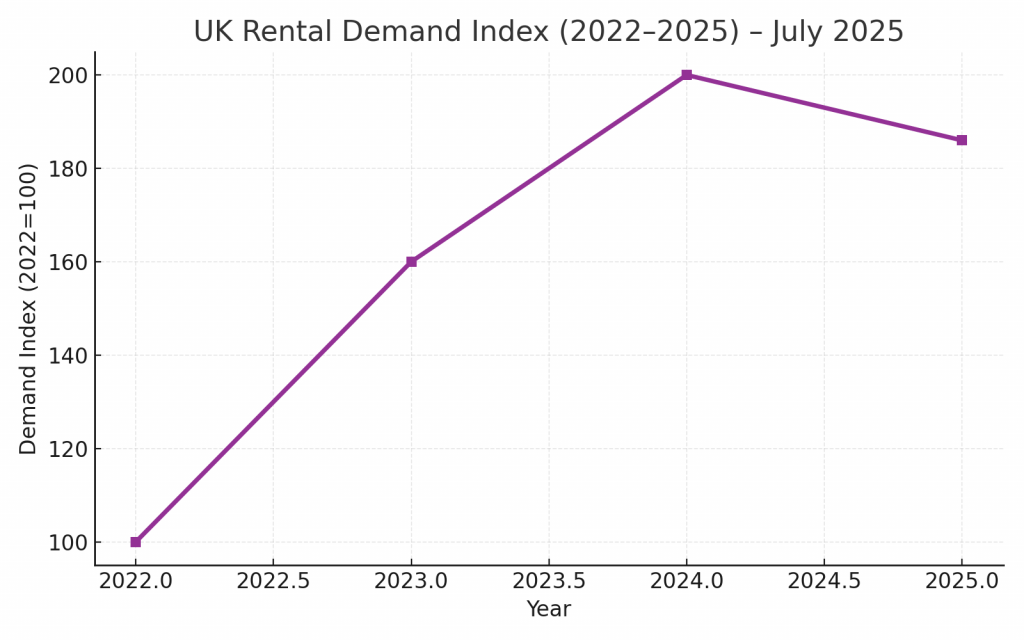

The UK Rental Demand Index dipped to 186 in July (base year 2022 = 100), continuing its modest decline from the 2024 peak of 200. While demand is softening, it remains significantly higher than pre-pandemic levels.

Drivers of the current demand pattern:

High mortgage rates are still preventing many renters from buying.

Lifestyle trends favoring renting persist, especially among professionals and mobile workers.

Ongoing housing shortages continue to limit tenant choice and competition.

Housing Supply Constraints Worsen

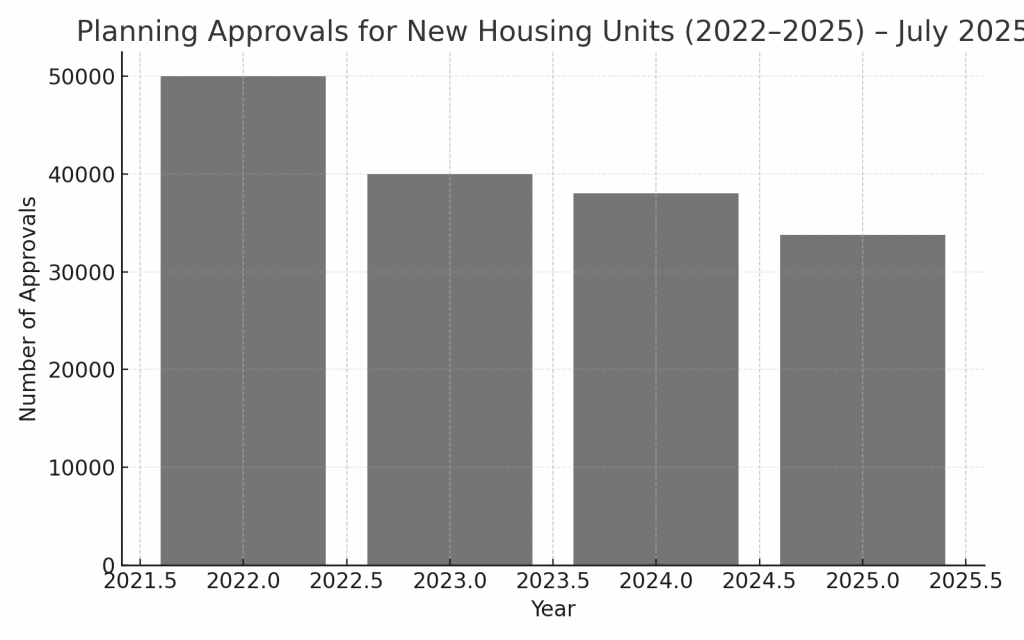

Planning approvals for new housing units fell again in July to 33,800 units, marking the lowest point since 2021. This contraction in the housing pipeline poses long-term challenges for the rental sector.

Contributing factors to the supply crunch:

Private landlord exits remain high due to tax pressures and regulatory changes.

Build-to-rent projects are expanding but remain insufficient to replace lost private rental stock.

Slow planning processes continue to delay housing development.

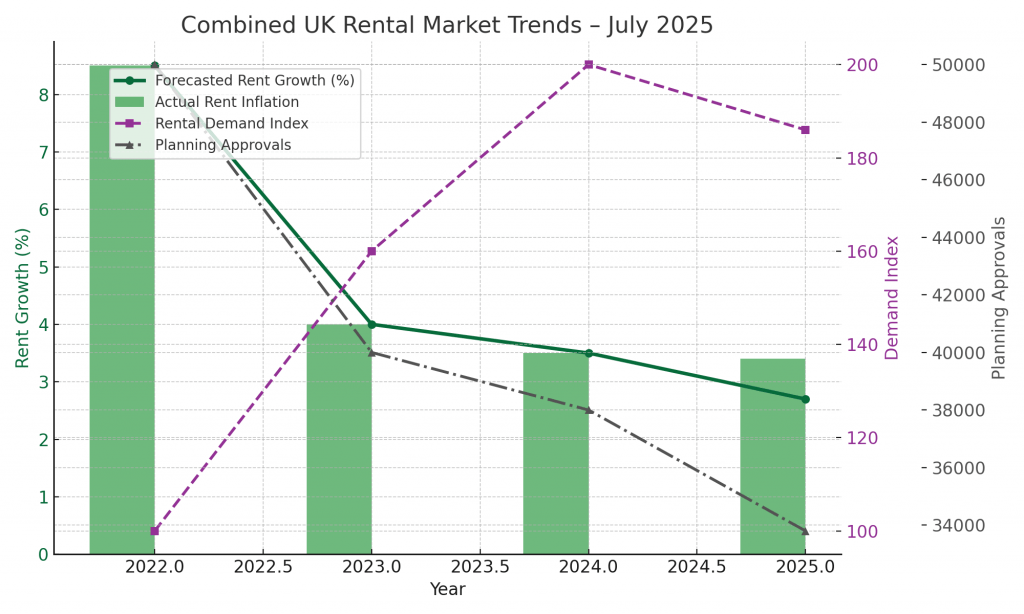

Combined View: Key Market Pressures at a Glance

This multi-axis chart provides a clear overview of all the trends shaping the rental market between 2022 and 2025

Market Outlook for the Second Half of 2025

The UK rental market is entering a period of slower growth but sustained imbalance:

Rent growth will remain positive but modest, constrained by affordability.

Demand will stay elevated, especially if interest rates remain high into 2026.

Supply shortages will persist, risking a return to higher rental inflation if economic or demographic pressures shift.

Without policy interventions targeting planning reform, rental sector support, and increased build-to-rent initiatives, structural pressures will continue to define the rental market into 2026 and beyond.